The Merchant of Record for Global Growth

Reach is the Merchant of Record that manages payments, local acquiring, FX, and tax compliance—so you can expand faster, capture more sales, and grow globally without added complexity.

Faster Global Growth Starts Here

Managing payments, FX, and international tax compliance in-house is costly and complex. Reach takes on that burden as your Merchant of Record, combining local acquiring, automated tax filing, and FX optimization in 200+ markets. With our integrations you can expand faster, lower costs, and boost approvals without rebuilding your commerce infrastructure.

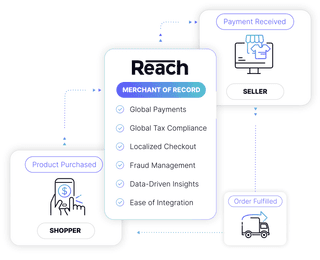

How does a Merchant of Record work?

Reach takes on the risk and complexity of global commerce so your business can expand without new entities or compliance headaches.

Clear FX & settlement

Optimized foreign exchange (FX), local settlement and simple reconciliation.

Why leading brands choose Reach:

A scalable partner you can rely on.

Reach is built for growth. As your Merchant of Record, we handle global payments, local acquiring, tax filing, and compliance in 200+ markets—so you can expand without new entities or added risk. Backed by enterprise-grade security and already integrated with Shopify and other major platforms and PSPs, Reach scales with your business from first market entry to global enterprise.

Talk to an expert.

Take the next step in scaling your global business. With Reach as your Merchant of Record, we'll handle the heavy lifting so you can focus on driving growth and innovation.